Deciding whether to rent or buy a home is one of the biggest financial decisions you’ll make, but is it right for you? While there’s no one-size-fits-all answer, understanding the pros and cons of each option as your lifestyle, income and priorities evolve can help you make the best choice for your current stage in life.

Before choosing whether to rent or to own a house, you need to be aware of the expenses and restrictions associated with both options.

To help you choose which living situation could work best for you, take a look at our comparison chart below.

| Renting | Owning a house |

|---|---|

| •Ability to continue saving for a down payment. | •Build equity. |

| •Not responsible for maintenance costs. | •Responsible for all maintenance and repairs costs. |

| •Low likelihood of being able to customize paint colours, flooring etc. | •Ability to customize home to your style. |

| •Easier to pick up and move with no strings attached. | •Much more difficult to pick up and move. |

| •Landlord could ask you to move out. | •No restrictions on pets (potential city or RM restrictions may apply). |

| •Could have restrictions on pets. | •Potential to be your own landlord and have an income suite. |

| •Potential for noise depending on the type of rental. | •Tax free gains (value of your home goes up, therefore increases the equity). |

| •A pillar for retirement. – once ready, you can sell your home for a decent retirement nest egg. |

Pro Tip: Holding off on buying a home and continuing to rent can help you build up a healthy down payment that will get you out of debt faster!

Renting: Flexibility with Fewer Commitments

Renting gives you the freedom to move easily, avoid maintenance costs, and often requires less upfront money. It’s a great option for people who:

- Are just starting out in their careers

- Plan to relocate in the near future

- Want to prioritize flexibility or saving before settling down

In Your 20s:

Your 20s are often about exploration. This could include starting a new job, travelling, or even living in different cities. Renting allows you to stay agile while saving for future goals like a down payment. Plus, renters don’t need to worry about property taxes, home repairs, or fluctuating housing markets.

Renting in Your 30s: Still a Smart Choice

Homeownership isn’t always the default next step in your 30s. Renting may be the right move if:

- You’re still exploring career opportunities or moving cities

- You’re saving aggressively for a larger down payment, other life goals, or investments

- You value low maintenance living and prefer building your financial wealth in other ways, such as an RRSP or TFSA

- You want to test-drive a neighbourhood or city before committing long-term

In short: Renting can still be strategic in your 30s, especially if flexibility, financial freedom, or lifestyle choices take priority.

Owning: Building Equity and Long-Term Stability

Owning a home offers the ability to build equity, benefit from market appreciation, and make your space truly yours. While there’s more responsibility involved, there’s also potential for long-term financial gain.

In Your 30s:

Many people begin to prioritize stability, family, and financial growth in their 30s. If your income is steady and you’re ready to commit to a location, homeownership may be the next step. Your mortgage payments help build equity, and with today’s competitive mortgage rates, buying a home could be more affordable than you think.

Owning in Your 20s: Possible and Powerful

For those in their 20s who are financially ready, homeownership can be an empowering step toward building long-term wealth. It might be the right fit if:

- You have a stable income and low debt

- You’ve saved enough for a down payment, and are taking advantage of registered plans such as an FHSA or TFSA

- You’re planning to stay in the area for a few years

- You’re interested in real estate as an investment

If you’re able to start early, it gives you more time to grow your equity and for your mortgage to shrink!

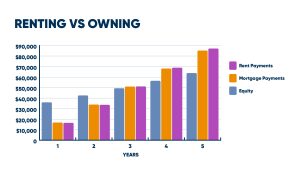

Rent or Own Comparison

The following chart demonstrates a comparison between renting vs. owning your home.

After 5 years, you will have accumulated $64,133.20 equity in your home, and your mortgage payments will be less than your rental payments over the same time period.

Data used to determine accumulated equity:

So, What’s Right for You?

Here are some questions to ask yourself when determining what’s right for you:

- Do you plan to stay in one place for at least 3-5 years?

- Is your income stable enough to support monthly mortgage payments and upkeep?

- Have you saved enough for a down payment and closing costs?

- Are you ready for the responsibilities that come with homeownership?

If you answered “yes” to most of these, it may be time to start exploring homeownership! If not, renting might be the better fit, for now.

Think Long-Term, Act Short-Term

You don’t have to have it all figured out. But taking the time to understand your financial situation and future goals will help you make smart, informed decisions.

Whether you’re renting, ready to buy, or somewhere in between, our team can help guide you towards the right path now, and for the future.

Want to chat with one of our experts? Contact us at 1-877-WESTOBA or visit Branches to get in touch.